Over the past 12 months, Bitcoin’s hashrate has increased by 85.77%, while 53,547 blocks were mined and 334,668.75 new bitcoin were minted into circulation. More than two dozen bitcoin mining pools have dedicated hashrate toward the Bitcoin blockchain during the last six years, and while the hashrate is 22,900% higher, the number of bitcoins found per year is a whole lot less.

334,668 Bitcoin Minted Since September 2021 — Foundry USA Captures the Most Blocks

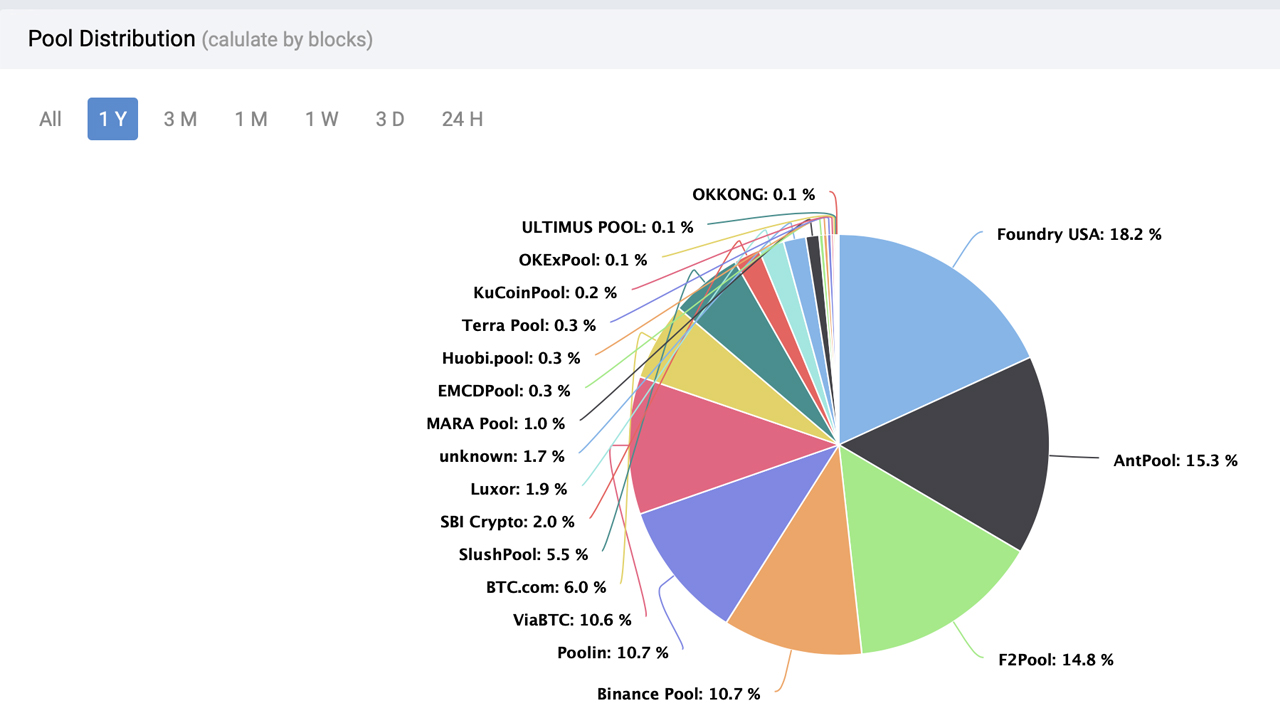

Miners accrued just over 334,668 BTC since September 10, 2021, and 53,547 blocks were found during the past 12 months. Foundry USA has been the top mining pool out of the 28 mining pools that found blocks during the past year.

Foundry captured 18.14% of the year’s global hashrate average and found 9,716 blocks. Antpool was the second largest miner during the past year, capturing 15.31% of the global hashrate. Antpool managed to discover 8,198 blocks, or 51,237.50 BTC (not including fees) in 12 months.

-

12-month mining pool statistics on September 10, 2022.

Antpool is followed by F2pool’s 14.79% of the year’s hashrate, after the pool found 7,919 block rewards. Binance Pool was the year’s fourth largest mining pool with 10.72% of the 12-month hashrate average.

Binance Pool found 5,738 blocks this past year, which equates to 35.862.50 BTC (not including fees). Poolin took 10.69% of the global hashrate during the past 12 months finding 5,724 blocks. Unknown hash or stealth miners represented the 12th largest mining entity with 1.74% of the year’s global hashrate after stealth miners found 934 blocks.

Annual Block Reward Production Was the Same in 2016 and 2019, but Miners Discovered a Lot More Bitcoin Back Then

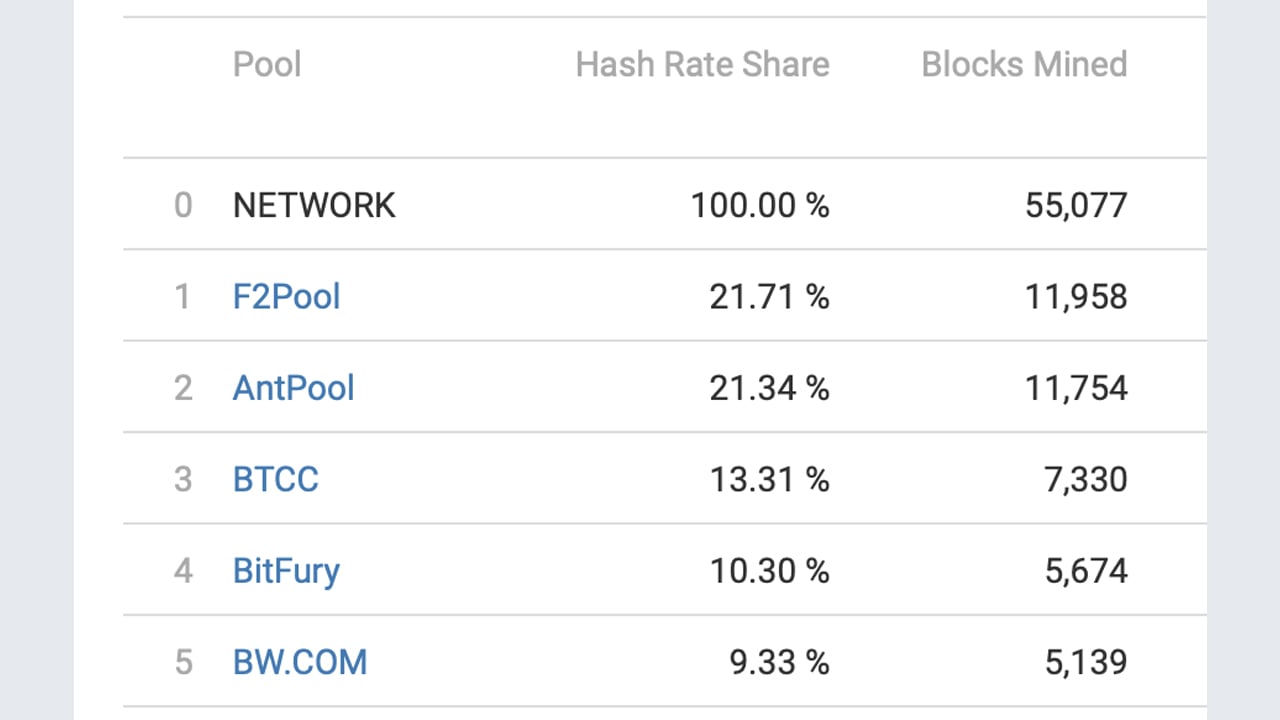

Things are a whole lot different than they were six years ago from today, as the hashrate hit 1 exahash per second (EH/s) in 2016. 27 pools were mining BTC in 2016 and 55,077 blocks were found that year.

The top mining pool in November 2016 was F2pool with 21.71% of the year’s global hashrate after it found 11,958 blocks that year. F2pool was followed by Antpool, BTCC, Bitfury, and BW.com, respectively. While the last 12 months has seen an 85.77% hashrate increase, since 2016 the hashrate has jumped 22,900% higher.

-

12-month mining pool statistics on November 24, 2016.

While the hashrate is a whole lot bigger than it was six years ago, the difficulty has increased a great deal as well. The number of bitcoins miners get nowadays is also much smaller. While 334,668.75 BTC was minted this past year, during the first six months of 2016, miners found 688,462.50 BTC, because the block reward was 25 BTC per block.

Moreover, during the latter half of 2016, only 344,231.25 BTC was found, but that’s still more than the 334,668 coins minted since last September. During the second half of 2016, miners got 12.5 BTC per block rather than the 6.25 BTC per-block reward miners get today and since May 2020.

In April 2019, 53,522 blocks were found that year and 669,025 new bitcoin were minted into circulation. Btc.com was the top miner at the time, after finding 10,468 blocks, and Antpool was the second largest pool, capturing 7,122 blocks in 2019.

While unknown hashrate represented 1.74% of the past year’s hashpower, in 2016 stealth miners were virtually non-existent. In April 2019, however, unknown hashrate captured 3.76% of the global hashrate during the 12-month span and found 2,013 blocks that year.

Despite the fact that miners get a lot fewer bitcoins per block than they did three years ago or six years ago, the price is higher, creating enough equilibrium to where miners still profit with all the expenditures they put into mining.

In February 2019, bitcoin’s price was $3,464 per BTC and the USD value at the time made it so only a few mining rigs were profitable. Using Bitcoin’s February 2019 difficulty metric, the price, and $0.12 per kilowatt-hour in electricity costs, only three SHA256 mining rigs were profitable.

What do you think about the last 12 months of bitcoin block production? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer